The coverage is only as good as your agent.

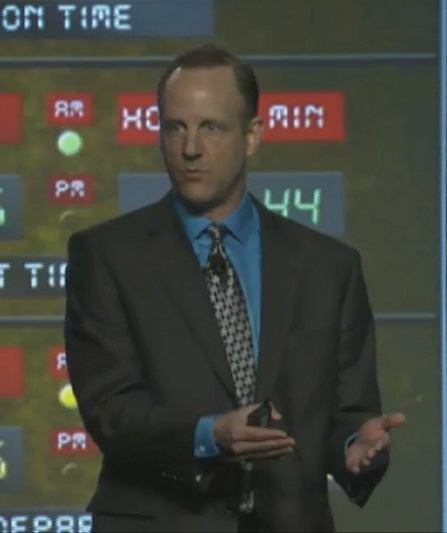

I recently appeared on Steve Savant’s Money, The Name of the Game. This is episode 5 of a 5 part series regarding Voluntary Benefits. Below are excerpts from the press release announcing this episode. You can listen to the audio as a podcast or watch the video that appears at the bottom of this page.

Press Release

Your insurance agent makes all the difference. A good Voluntary Benefits agent can help you choose the right policies for your family.

Many consumers can get confused by the multitude of choices they face when choosing a Voluntary Benefits policy and an insurance company. A good agent makes these decisions easier.

Once a consumer knows the basic types of Voluntary Benefit policies that are available, and what to look for in an insurance company, they still may have many questions. A good insurance agent can help them clarify the best options for them. There are several factors you should consider when choosing an agent.

Longevity – How long has the agent been in business? Many insurance companies are recruiting machines. There is a chance your agent was working in a retail job last month. We all have to start somewhere. By definition, no one has insurance experience the day they start. If they are new, is there an experienced agent with them?

Professionalism – You definitely want to work with a true professional. Does your agent have solid knowledge of the entire health insurance marketplace, not just Voluntary Benefits? Are they involved in the community they serve?

Service – It is important to understand how committed your agent is to superior service. Will they give you their cell phone number? What is their promise of response time?

Diversity – Are they able to represent more than one insurance company? If they only represent one company, they can’t show you different options from different companies. Even if those choices might be a better option for you.

Focus – Do they represent too many insurance companies? I’m convinced that the phrase, “Jack of all trades, master of none” was written about many insurance agents. It is good to have diversity when choosing the right policy but if your agent represents 25 companies he can’t possibly know how each company and their policies might meet your needs.

There are many choices when it comes to the insurance agent you choose. You might as well choose the right one. Use this as a checklist to make sure the person that is advising you is the best fit for your family. Voluntary Benefits can stand in the gap between you and financial devastation. It is critical you know that your agent has your best interest at heart. If done correctly, the programs you purchase will help you when you need it the most.

Thank You For Listening

I really appreciate you listening to the podcast and would love it if you would be so kind as to rate the podcast on iTunes. To do that, all you have to do is go to https://successisvoluntary.com/iTunes and follow the instructions. It will take you less than 30 seconds and would be a huge help to me as it will keep the podcast towards the top of the business charts in iTunes which will help new people discover it. And don’t forget to give it some digital love. Please share on Facebook, Linkedin, Twitter, or anywhere else you hang out in the social media universe!

I look forward to seeing you back here next week, in the meantime, don’t forget that everything you do in this business is voluntary. Including success!!!